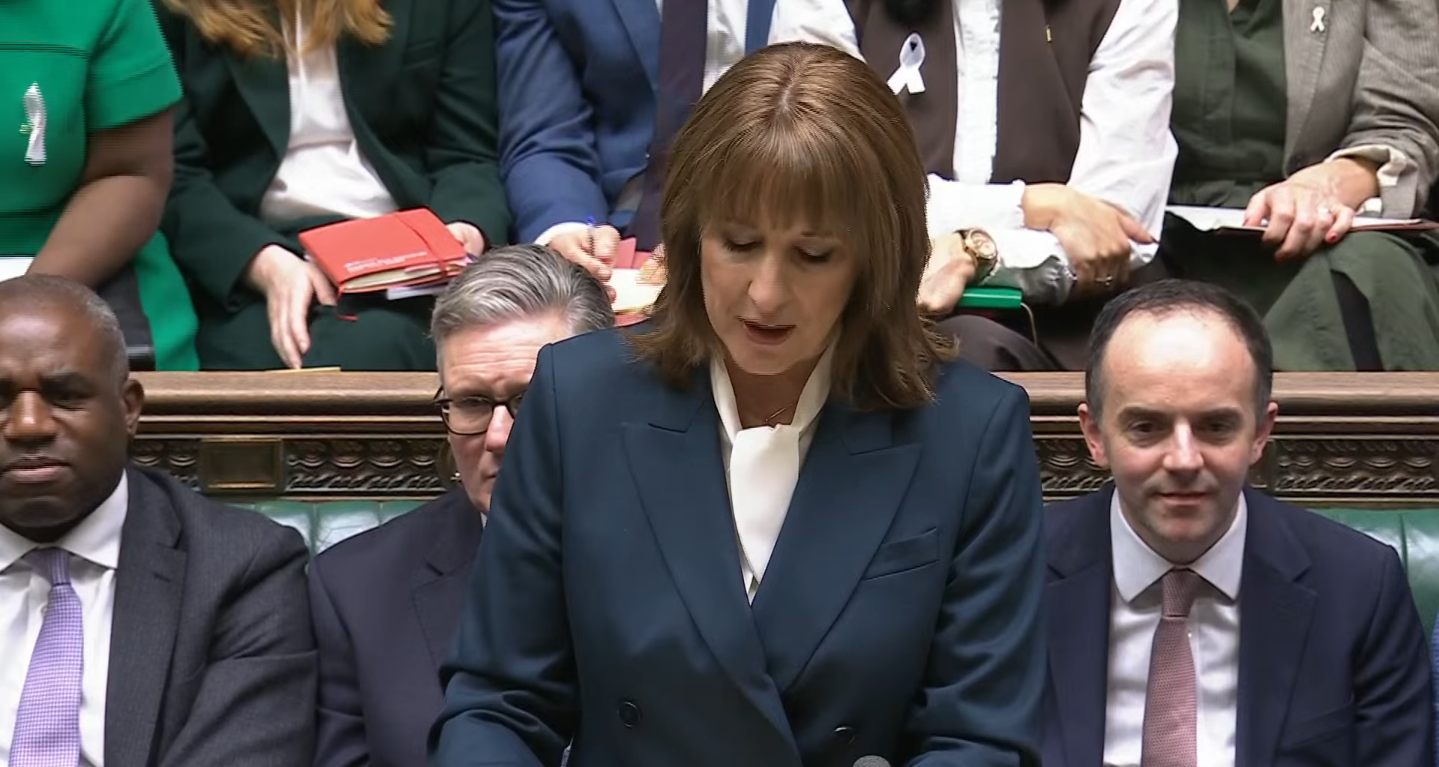

UK Budget today: timing, predictions and what Rachel Reeves may reveal

What to expect as the Chancellor prepares to deliver the 2025 Budget

The UK is bracing for a pivotal economic moment as Chancellor Rachel Reeves prepares to deliver the 2025 Budget today, with millions of households, businesses and investors waiting to learn how tax, spending and welfare policies will reshape the year ahead. The Budget will be presented in Parliament this afternoon, in what is expected to be one of the most closely monitored fiscal announcements of the decade.

Timing of the speech has been confirmed for early afternoon, with full documents from the Treasury set to follow shortly after the Chancellor completes her address. Market reactions are expected to begin almost immediately, especially from banking, investment and retail sectors that have been preparing for major financial adjustments. The first hour after the announcement is expected to set the tone for the economic narrative of the coming months.

Predictions ahead of the Budget point strongly toward a set of wide-reaching tax reforms, with particular attention on income-tax thresholds. Analysts widely believe Reeves will keep current freezes in place, resulting in more workers moving into higher tax brackets as wages rise. This tactic is seen as a significant revenue generator without increasing headline tax rates directly.

There is also strong anticipation of changes to the taxation of savings and investment income. Industry observers expect new rules affecting dividends and high-interest savings accounts, which are projected to reduce tax advantages for higher-earning investors. The government is positioning these reforms as part of a broader plan to modernise and balance contributions across different income types.

Property taxation remains one of the most talked-about areas ahead of the speech, particularly regarding high-value homes worth more than £2 million. Forecasts suggest that Reeves may introduce increased charges on luxury properties to ensure that the wealthiest homeowners contribute more to public finances. The housing sector has been preparing for immediate shifts in buyer sentiment following the announcement.

A series of consumer-linked taxes could also be unveiled, with speculation around updates to duties on sugary drinks, gambling services and other lifestyle-driven purchases. Policymakers are expected to position these changes as a way to pair public-health incentives with revenue generation. If confirmed, the adjustments could influence behaviour patterns across leisure, retail and hospitality industries.

Changes to pension and payroll rules are expected to feature significantly, particularly around salary-sacrifice schemes and National Insurance structures. Businesses have been exploring contingency planning in anticipation of reforms that could affect employer contributions and long-term pension arrangements for staff. These adjustments would represent one of the most meaningful shifts to workplace benefits in recent years.

While the Budget is forecast to raise revenue across several fronts, Reeves is also expected to introduce major welfare support measures, led by the removal of the two-child benefit cap. Supporters of the reform say it will provide life-changing relief for low-income families and improve social outcomes across the UK. The Treasury is likely to position this as a demonstration of economic fairness alongside fiscal responsibility.

Public service investment is expected to be another headline theme, with increased funding projected for healthcare, education, social care and local authorities. Reeves has previously stated that the government aims to rebuild essential services without returning to austerity or creating unsustainable national debt. The speech today will outline how that balance will be achieved in practical terms.

The overall tone of the Budget is expected to emphasise long-term financial stability while attempting to cushion vulnerable households from the immediate impact of tax changes. The real-world effect will vary depending on income level, property status and savings profile, meaning UK citizens may feel both relief and pressure in different areas of their finances. With the country watching closely, today’s Budget will determine the direction of the UK economy and shape the financial decisions of millions for the year ahead.