Budget news: UK government set for biggest tax shake-up in years

Major Shifts Ahead as the UK Prepares for a New Fiscal Direction

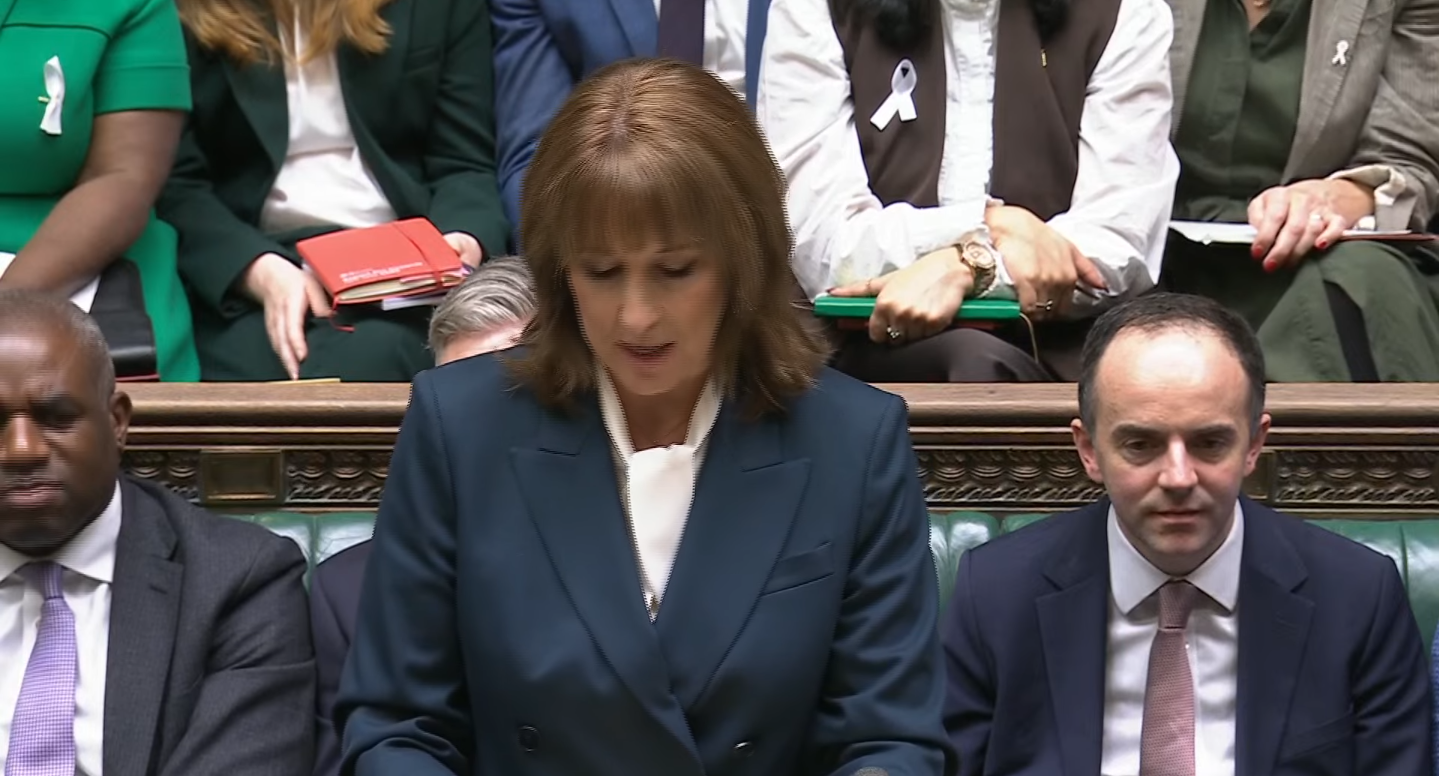

The UK government is preparing to deliver what is widely viewed as the most significant overhaul of the tax system in years. With Rachel Reeves set to present the latest Budget, the Treasury is positioning this announcement as a transformative moment aimed at stabilising public finances, boosting revenue and resetting long-term economic planning. The scale of proposed changes has drawn widespread attention across the country.

A central part of the shake-up involves freezing income tax thresholds for several more years. This measure effectively pulls more earners into higher tax bands as wages rise, increasing contributions without altering headline rates. For many households, this means a gradual but noticeable change in take-home pay as inflation and pay adjustments interact with static levels.

Another major move involves changes to pension tax arrangements. The longstanding advantages of using salary-sacrifice schemes are expected to be reduced, affecting millions of workers. This shift is designed to close what government officials describe as “unbalanced tax gaps,” though critics warn it may discourage long-term saving and place extra strain on retirement planning.

Property remains another area set for reform. The government plans to introduce tougher taxation for high-value homes, with properties worth £2 million or more likely to face new annual charges. This addition could reshape the landscape for wealthier homeowners, especially those in regions with high property valuations.

Landlords and investors are also watching closely. Adjustments to taxes on rental income and property profits could increase annual costs for those managing multiple properties. The intention, according to officials, is to ensure fairness in how investment income is taxed compared with traditional earnings.

Everyday spending is expected to change too, with new or expanded duties across selected goods and services. Gambling firms are likely to see higher levies, and consumers could feel the effect on betting prices. Additional charges on items such as sugary drinks, including milk-based beverages, may also push up everyday costs for shoppers.

The possibility of new forms of transport taxation has raised further debate. As electric vehicle ownership grows, the government is exploring ways to replace declining fuel duty revenue. Any new structure for EV-related taxation may influence running costs for drivers over the coming years.

These combined measures are forecast to raise tens of billions of pounds, helping to support public services and manage the deficit. Supporters argue that targeted increases are essential for long-term stability. They say the focus on wealthier households, high-value assets and non-essential consumption spreads the tax burden more fairly.

However, the impact on everyday life remains a concern. Middle-income families may feel pressure from threshold freezes, reduced pension perks and increased living costs. Business groups warn the changes could influence investment and slow momentum in key sectors, adding a layer of uncertainty during an already challenging economic period.

With the Budget shaping the UK’s financial direction for years ahead, the scale of the tax overhaul signals a decisive shift by the government. As the full details take effect, households and businesses will be watching closely to understand how these changes translate into real-world outcomes, marking one of the most consequential fiscal moments in recent memory.