BTC stabilises after major swings — what’s next for UK investors?

Market Calm Returns After a Turbulent Week

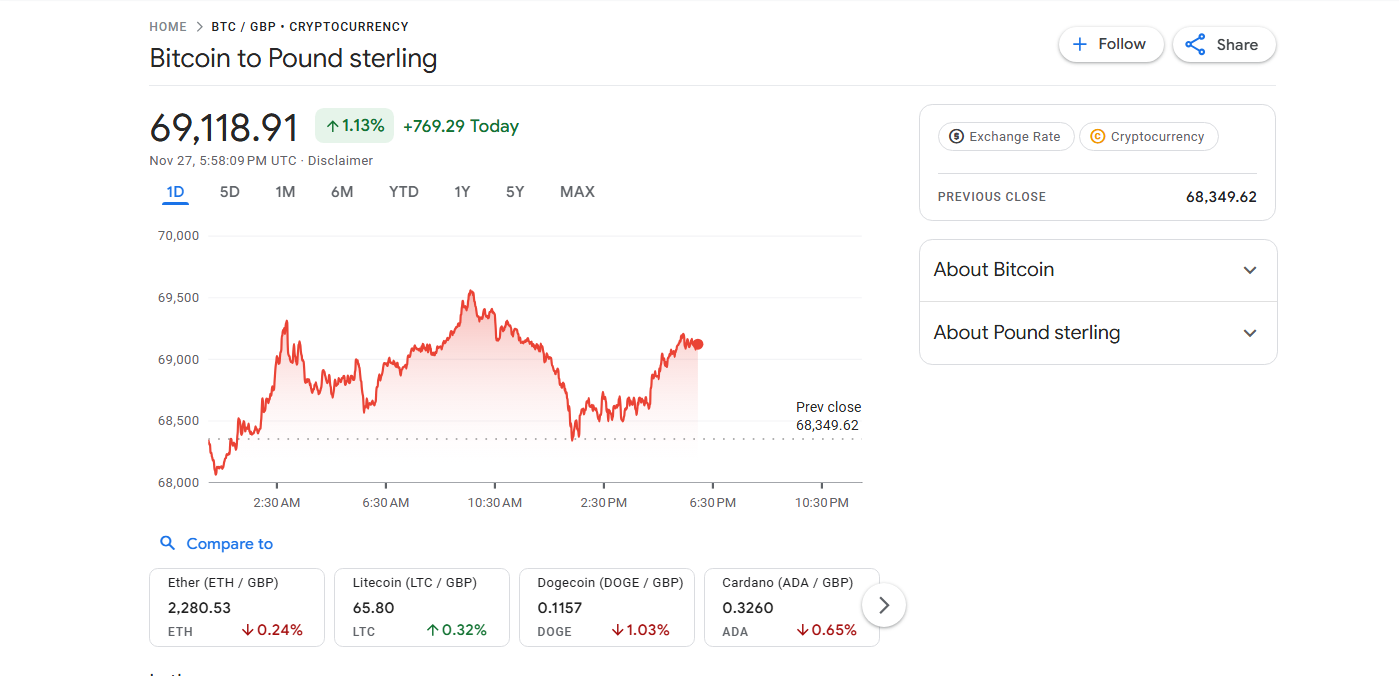

Bitcoin has steadied after a volatile period that saw prices swing sharply in global trading. UK investors are now assessing what this stabilisation means for the months ahead, especially as wider economic pressures continue to influence crypto markets. The recent pause in extreme movements suggests some cooling after a week dominated by heavy selling and rapid rebounds.

The latest price behaviour follows a correction triggered by shifting market sentiment and uncertainty surrounding global financial conditions. Bitcoin’s surge earlier in the year had prompted a wave of speculative interest, but the subsequent pullback reminded investors of the asset’s ongoing sensitivity to sudden shifts in demand. Stabilisation now signals that traders may be recalibrating their positions.

Analysts say the current calm could be a temporary consolidation phase. Periods of sideways movement often follow large swings as markets digest new information. UK investors watching the charts will be weighing whether this plateau represents a healthier base or a pause before further volatility. Much will depend on broader economic updates expected in the coming weeks.

Institutional interest remains one of the key drivers affecting expectations. Recent data from leading exchanges and custody providers indicates continued appetite from funds and corporate buyers, even after the recent turbulence. This steady involvement suggests that major players still see long-term value in Bitcoin despite the short-term instability.

On the retail side, UK traders have shown resilience during the downturn. Many long-term holders appear to have maintained positions rather than selling into the drop. This behaviour aligns with a wider trend of UK investors adopting more disciplined strategies, particularly as crypto becomes more established within mainstream financial discussions.

Regulation remains a defining factor for the UK market outlook. Authorities continue to expand oversight and develop clearer rules around digital assets, aiming to protect consumers while encouraging innovation. Any updates from regulators or government departments could influence sentiment, particularly for investors who favour a more structured environment.

Market analysts have also pointed to macroeconomic signals as key contributors to Bitcoin’s path ahead. Interest rate expectations, inflation readings and global growth forecasts all play a role in shaping risk appetite. If conditions stabilise across major economies, cryptocurrencies may benefit from renewed optimism among investors.

For now, Bitcoin’s ability to hold steady offers a brief window for UK investors to reassess risk exposure. Many experts encourage a long-term perspective, reminding buyers that digital assets remain prone to sudden movements. As markets mature, however, periods of consolidation like this may become more common.

UK investors considering adjustments may look at strategies that smooth out volatility, such as gradual accumulation or diversified portfolios. These approaches have grown in popularity as more people treat crypto as one component of a broader financial plan rather than a standalone speculation.

The coming weeks will reveal whether Bitcoin’s latest stabilisation marks the start of a more predictable phase or merely a pause between swings. For now, traders and long-term investors alike are watching closely, ready to respond to shifts in sentiment as global conditions evolve.