Landlords told to brace for £750 rise in annual tax on rental income

New tax changes set to tighten pressure on UK property owners

The government’s 2025 Budget has introduced a series of measures that will significantly increase the tax burden on landlords across the UK. Among the most notable changes is an estimated £750 rise in annual tax for many property owners, driven by adjustments to rental income taxation and broader fiscal reforms. The move forms part of the Chancellor’s strategy to raise revenue while rebalancing the housing market and supporting public services under strain.

According to official Budget documents, landlords will see the effective tax rate on rental earnings increase through a combination of altered allowances, tightened reliefs and changes to the wider income-tax system. The freeze on personal tax thresholds continues to push more rental income into higher bands, accelerating the amount landlords must pay. These measures, taken together, create a substantial shift in how rental profits are treated.

The government has also confirmed restrictions on certain landlord-related deductions, reducing the scope for offsetting expenses against tax liabilities. While many landlords have long relied on these allowances as part of their financial planning, the revised framework will make the rental market less favourable for those with multiple properties or high levels of mortgage interest. The Budget’s approach signals a firmer stance on discouraging speculative property ownership.

Alongside income-tax changes, adjustments to capital gains rules and property-related levies add further pressure. Landlords selling assets may face higher liabilities due to altered thresholds and updated valuation criteria. The government argues that these reforms help address distortions in the market while generating additional revenue for essential services. However, industry bodies warn that the cumulative effect may deter investment in rental housing.

For many landlords, rising mortgage costs compound the impact of the revised tax regime. With interest rates still elevated, the additional £750 in average annual tax adds another layer of pressure to profit margins that have already narrowed in recent years. Smaller landlords, in particular, may find it increasingly challenging to maintain competitive rental rates while covering higher operating expenses.

Tenant organisations have responded by suggesting that the measures could help ease long-term market imbalances. They argue that making property investment less profitable may reduce competition from portfolio landlords, opening opportunities for first-time buyers and improving affordability. However, concerns remain that some landlords may pass on additional tax costs to tenants through higher rents, especially in tight local markets.

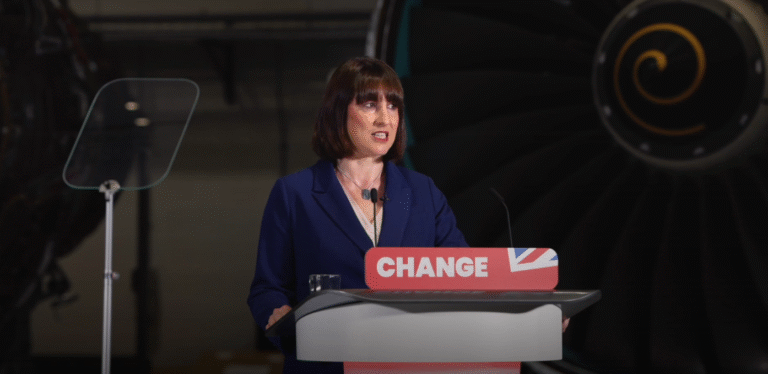

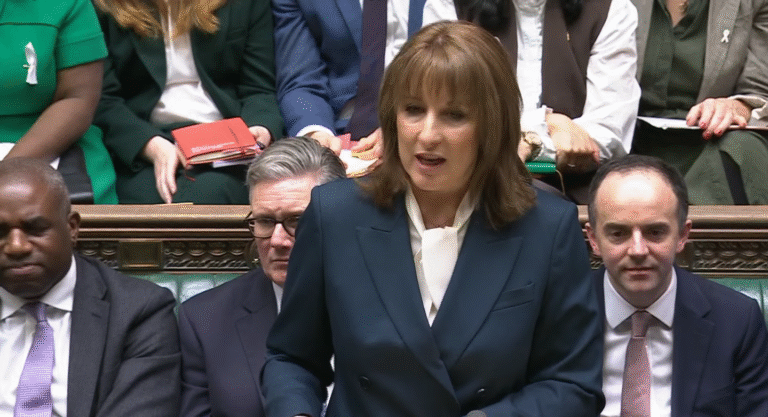

The Chancellor has defended the policy as part of a broader effort to stabilise public finances and create a more balanced housing system. By increasing tax contributions from rental income, the government aims to fund commitments to public services while adjusting incentives within the housing sector. Ministers say the reforms reflect a fairer distribution of fiscal responsibility at a time of economic challenge.

Industry experts caution that the long-term consequences could include reduced supply in the private rented sector if landlords choose to exit the market. Some analysts predict an uptick in property listings as owners reassess the viability of their portfolios under the new tax conditions. Should this occur, it may create short-term opportunities for buyers but potential uncertainty for existing tenants.

Despite the headline £750 figure, the actual increase will vary based on individual circumstances, including property location, mortgage structure and total income. Landlords with higher rental yields or multiple properties are likely to experience larger rises, while those with modest earnings may see smaller adjustments. Financial advisers are urging property owners to review their calculations carefully in light of the new rules.

As the changes take effect, landlords are being advised to plan proactively, reassessing everything from rental prices to maintenance budgets and long-term investment strategies. With the 2025 Budget marking one of the most substantial recalibrations of rental taxation in recent years, property owners face a period of adjustment. The lasting impact on the housing market will become clearer as the reforms filter through, shaping decisions for landlords, renters and prospective buyers alike.