ISA Passive Income for Life

Generating £1,000 Monthly Passive Income with ISAs

Individual Savings Accounts (ISAs) are a popular way to save and invest in the UK, offering tax-free returns on investments. To generate £1,000 a month in passive income, you’ll need to consider several factors, including the type of ISA, investment amount, and interest rate.

The most common types of ISAs are Cash ISAs, Stocks and Shares ISAs, and Lifetime ISAs. Each has its own set of rules and benefits, so it’s essential to choose the right one for your needs. A Stocks and Shares ISA, for example, can provide higher returns over the long term but comes with a higher level of risk.

To calculate how long it would take for an ISA to pay you £1,000 a month, you can use a compound interest calculator. This will help you determine the required investment amount and timeframe based on your desired monthly income. It’s also important to consider inflation, as it can erode the purchasing power of your money over time.

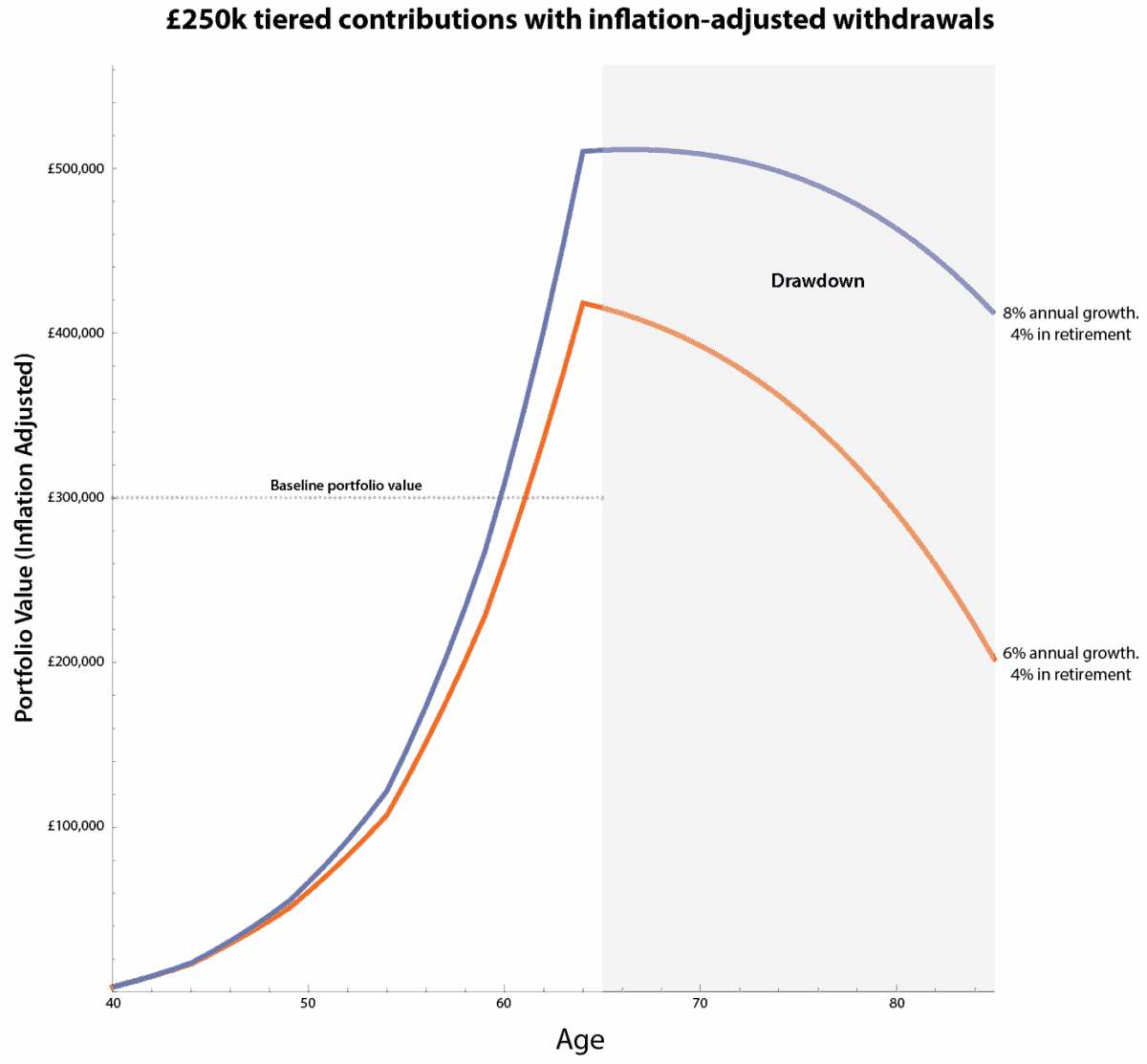

Assuming an average annual return of 4-5%, a £1,000 monthly income would require a significant investment. You can use the 4% rule as a rough guide, which suggests that a sustainable withdrawal rate from a retirement portfolio is 4% per year. Based on this, you would need a pot of around £300,000 to generate £1,000 a month.

In addition to the investment amount, you should also consider the fees associated with your ISA. These can include management fees, platform fees, and other charges, which can eat into your returns. It’s essential to shop around and compare fees from different providers to find the best deal.

Another factor to consider is the impact of tax on your ISA. While ISAs are tax-free, you may still be liable for tax on any income or gains outside of the ISA. It’s crucial to understand your tax position and plan accordingly to minimize your tax liability.

In conclusion, generating £1,000 a month in passive income from an ISA requires careful planning, patience, and a solid understanding of the investment landscape. By choosing the right ISA, investing wisely, and minimizing fees, you can create a sustainable source of income for life.

It’s also important to review and adjust your investment portfolio regularly to ensure it remains aligned with your goals. This may involve rebalancing your portfolio, switching investments, or exploring alternative options such as peer-to-peer lending or property investment.

Ultimately, the key to achieving your financial goals is to start early, be consistent, and stay informed. By doing your research, seeking professional advice when needed, and staying committed to your strategy, you can increase your chances of success and enjoy a more secure financial future.