Budget 2025 live: Rachel Reeves confirms sweeping tax rises for UK households

What the Chancellor’s announcement means for families and finances

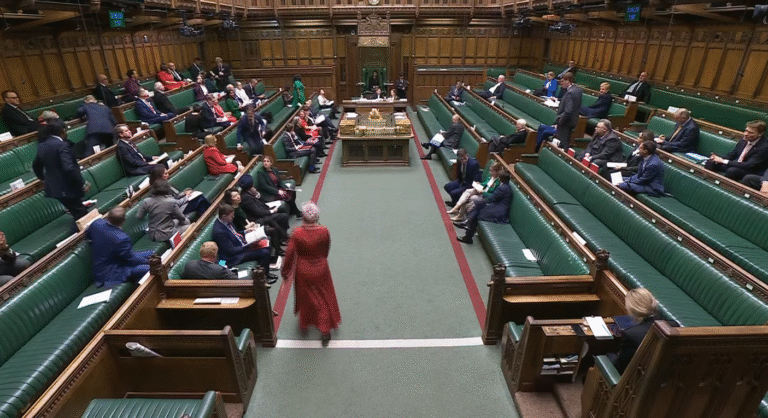

Rachel Reeves has delivered one of the most consequential Budgets in recent years, unveiling a wide-ranging package of tax rises and reforms intended to stabilise the UK’s public finances. The Chancellor described the measures as necessary to address long-standing fiscal pressures, with the government placing emphasis on fairness, economic repair and funding essential public services. Her statement sets the tone for a period of tighter taxation affecting households across the country.

A central feature of the Budget is the extension of the freeze on income-tax thresholds, now set to continue until the early 2030s. This means millions of workers will pay more tax over time as their wages increase, even though the headline tax rates remain unchanged. The government expects this measure alone to generate billions in additional annual revenue. While ministers argue it provides a predictable way to raise funds, many households will notice the effect through higher monthly deductions.

Reeves also confirmed significant changes to the taxation of savings, dividends and investment income. Reductions to certain allowances and higher charges on specific forms of income will impact savers, landlords and individuals who rely on returns from assets. The measures are part of the government’s strategy to broaden the tax base, but they are likely to influence financial planning for those with long-term savings or diversified sources of income.

High-value property owners are among the groups most directly affected. The Budget introduces a surcharge on homes valued above £2 million, reflecting the government’s intention to shift more of the tax burden toward wealthier households. Ministers say the move will help raise substantial revenue without affecting the majority of homeowners. However, those in regions with expensive housing markets may see notable increases in annual costs.

The Chancellor also confirmed future changes to pension-related tax benefits. Adjustments to salary-sacrifice schemes are scheduled to take effect later in the decade, reducing tax advantages for higher contributions. This represents a major shift in how workplace pensions operate and may prompt individuals to rethink their retirement strategies. The government insists the reform is aimed at closing gaps in the system and ensuring it remains sustainable.

Other tax rises will touch specific sectors, including gambling and parts of the consumer goods market. Businesses facing higher levies are expected to adjust their pricing over time, which may contribute to rising costs for certain activities and services. A planned shift towards mileage-based charges for electric vehicles was also referenced, signalling the start of a long-term transition away from traditional fuel duty as more drivers adopt low-emission cars.

Alongside these increases, Reeves announced several measures designed to support households facing cost-of-living pressures. The two-child benefit cap is being scrapped, widening support for larger families. In addition, energy bills are expected to fall next year following the removal of certain levies, offering some relief as inflation remains elevated. These steps are part of the government’s pledge to protect vulnerable families even as it raises revenue elsewhere.

The Budget also outlines continued commitment to public services, with funding directed toward the NHS, education and key infrastructure projects. Reeves emphasised that long-term investment is essential for improving economic resilience and delivering better outcomes for communities. However, she stressed that such investment must be matched by a stable revenue base, reinforcing the government’s rationale for today’s tax-heavy package.

Market reaction will be closely watched in the days ahead. Early signals suggest investors are assessing the credibility of the government’s approach, particularly in light of new economic forecasts showing modest growth and ongoing fiscal challenges. The balance between raising revenue and maintaining confidence will play an important role in shaping future borrowing costs and economic sentiment.

For households, the impact of the Budget will vary widely depending on earnings, assets and spending habits. Some will feel the effects immediately through higher taxes on income and savings, while others may face increases more gradually as businesses pass on higher costs. At the same time, targeted support for families and changes to energy bills may offer a counterweight for many.

Reeves’s Budget marks a decisive shift in the government’s fiscal strategy, combining substantial tax rises with targeted relief measures and long-term investment plans. As the measures unfold over the coming months and years, families across the UK will be navigating a more demanding financial landscape shaped by the government’s commitment to restoring stability and funding essential national priorities.