Graphics Card Prices Surge in the UK Amid Growing AI Hardware Demand

UK Consumers Face Steep GPU Costs as AI Drives Market Shifts

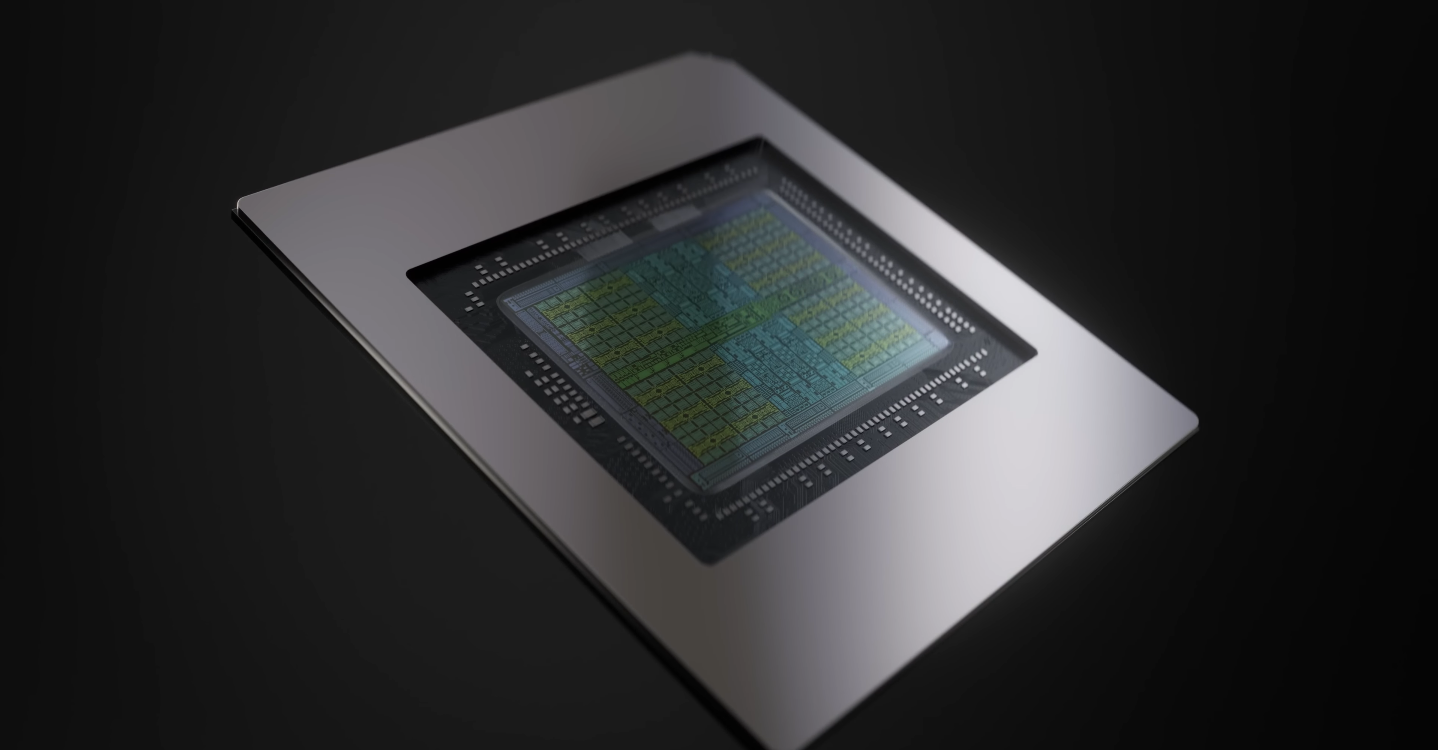

Graphics card prices in the United Kingdom have climbed sharply as demand for hardware capable of powering artificial intelligence workloads grows, reshaping supply chains and pricing for consumer GPUs. This trend is being driven largely by the global AI boom, where enterprise and data-centre buyers are prioritising advanced computing silicon over traditional gaming markets. Analyst reports show that memory shortages and shifting manufacturing capacity have exacerbated GPU costs.

UK buyers are feeling the impact of soaring prices, particularly for high-end models needed for modern machine learning tasks. Retailers have increased prices on flagship cards, with some reaching levels far above original suggested retail prices in recent months. The combination of memory cost inflation and limited stock has pushed average GPU prices higher across Britain, challenging affordability for gamers and creative professionals alike.

One of the core causes behind the surge is the strained global memory market, where producers like Samsung and SK Hynix have redirected capacity towards high-bandwidth memory for AI accelerators. The result is a scarcity of standard DRAM and VRAM modules used in consumer graphics cards, driving input costs upward. UK importers are reporting that these components are key cost drivers in finished GPU pricing, with effects felt at retail.

Major GPU makers have already signalled changes to pricing strategies in response to these supply pressures. Both AMD and Nvidia are facing industry-wide cost increases that are likely to be passed on to consumers, according to recent manufacturing and distribution forecasts. Mid-range and high-performance GPUs are expected to carry price premiums in early 2026, directly tied to memory cost trends and allocation to enterprise customers.

In the UK context, the broader semiconductor shortage has combined with regional market forces, including import tariffs and logistical complexity, to further inflate prices. While demand from the UK’s gaming and esports community remains strong, enterprise and cloud computing sectors are now absorbing much of the high-end GPU supply, leaving fewer units for consumer markets. This shift has reduced the availability of popular cards in UK retailers.

The surge is not limited to top-tier hardware. Prices for mid-range GPUs have also seen uplift, as memory costs filter down through production tiers. Many UK consumers report waiting longer for stock and paying significantly more compared with previous years, prompting some to delay purchases. The education and creative sectors, which rely on GPUs for tasks such as rendering and data science, are also facing tighter budgets because of the trend.

Analysts note that the situation represents a structural shift in the GPU market, not just a short-term blip. The ongoing global memory supply shortage triggered by AI demand has created a new baseline for GPU pricing, meaning that even future generations of cards may launch at higher costs than in the past. For UK buyers, this signals a period of elevated hardware prices.

Despite these price pressures, hardware makers are aiming to manage the transition without alienating key consumer segments. AMD has publicly stated its intent to work with partners to mitigate drastic price hikes for gamers, while Nvidia continues to prioritise its high-performance AI-oriented chips that command strong enterprise demand. Both strategies will influence availability and pricing in the UK throughout 2026.

Some industry observers believe that GPU prices could stabilise if memory production expands or if AI hardware demand plateaus. However, current forecasts suggest that strong demand for AI compute will persist, meaning UK shoppers should prepare for continued premium costs on graphics cards for the foreseeable future.